Market Leader in Private Credit

KBRA brings a unique lens to the evolving Private Credit landscape, delivering sharp insights through deep research, dynamic webinars, and rigorous rating analysis.

Framing AI and Software Risk

KBRA presents data and observations to help frame the potential risks artificial intelligence (AI) may pose to the direct lending landscape, in the context of recent market volatility.

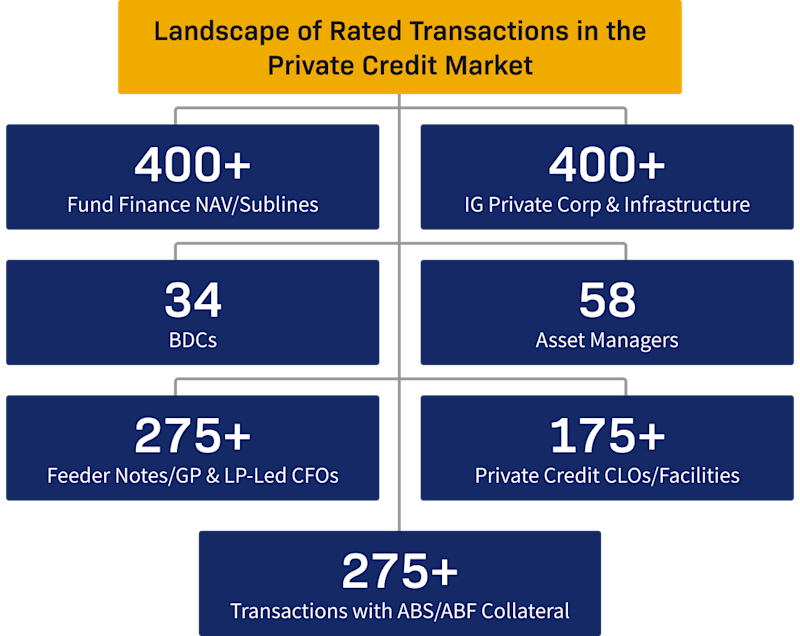

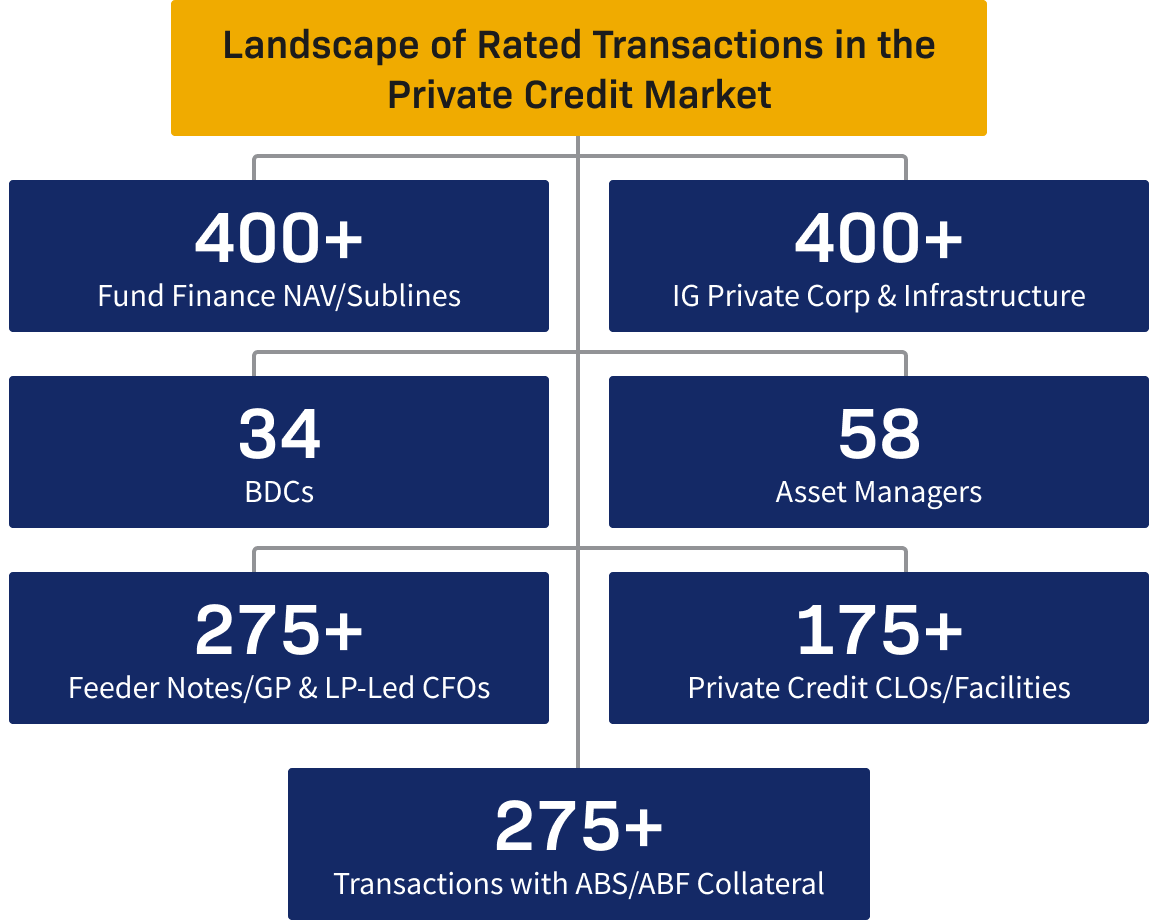

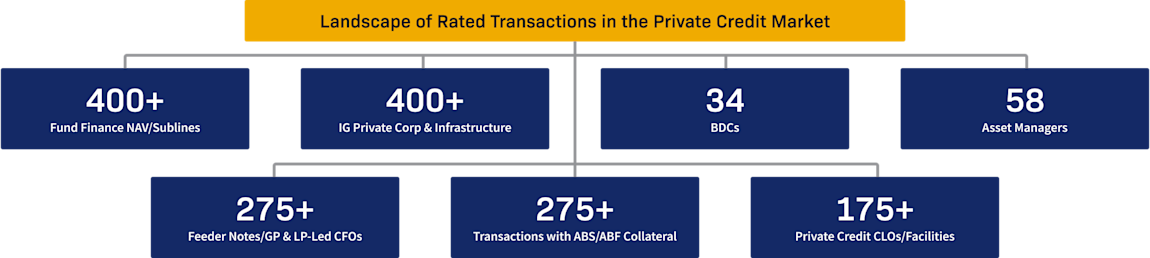

Expanding Use of Ratings in Private Credit

KBRA has over 1,000 ratings of transactions and issuers within the private capital universe and has worked with over 100 sponsors.

Performed 4,500+ underlying credit assessments on middle market sponsor-backed companies in 2025

Latest Private Credit Research

Framing AI and Software Risk

KBRA presents data and observations to help frame the potential risks artificial intelligence (AI) may pose to the direct lending landscape, in the context of recent market volatility.

From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

KBRA research explores evolving partnerships between life and annuity insurers and asset managers, noting broader deal structures that may support long-term sector stability.

Private Credit: 2026 Outlook

KBRA sees 2026 as pivotal for private credit, with strong growth and complexity, rising manager dispersion, and manageable but higher MM defaults expected.

Recurring Revenue Loan Metrics Dashboard: Q3 2025

KBRA continues to track and present several key metrics in a dashboard format, sourced from quarterly collateral loan tapes provided by the issuers of KBRA-rated recurring revenue loan (RRL) asset-backed securities (ABS).

Business Development Company (BDC) Ratings Compendium: Third-Quarter 2025 and 2026 Outlook

KBRA releases its Business Development Company Ratings Compendium, which looks at results for the quarter ended September 30, 2025, and 2026 Outlook.

Q3 2025 Middle Market Borrower Surveillance Compendium: Defaults Will Rise

KBRA releases its Q3 2025 Middle Market Borrower Surveillance Compendium, providing insights into credit quality across KBRA’s portfolio of rated direct lending transactions.

Webinars & Podcasts

KBRA's 2026 Private Credit Outlook Webinar

Join KBRA's sector experts on Wednesday, February 18 at 9:30 AM EST, for our 2026 Private Credit Outlook webinar. Tune in for a discussion that will explore the key forces shaping private credit in 2026—and what they mean for investors navigating a more complex and competitive landscape.

Absolute Credit Series Rated Funds & CFOs 2025 Update

KBRA Chief Rating Officer Bill Cox discusses growth in rated funds and CFO markets and how KBRA evaluates risk as private credit demand evolves.

3 Things in Credit: Spread Wideners, Private Credit Color, 2026 Risks

Listen on: Apple Podcasts YouTube Music Spotify

3 Things: Coming Tailwinds, Fed Drama, and Private Credit Data Update

Listen on: Apple Podcasts YouTube Music Spotify